Cash investing in a new world

| Cash management | |

|---|---|

| |

| Author | |

| BlackRock | www.blackrock.com/uk |

Introduction

Corporate treasury has become strategically more important for organisations since the financial crisis, with liquidity and risk at the forefront of investor importance. Corporates have built higher cash reserves in order to deal with volatile markets and to enable themselves to be more flexible. Many have taken advantage of the low interest rate environment and pre-funded their borrowing needs. However, monetary policy and regulations are creating new dilemmas for corporate treasurers when it comes to investing cash.

Challenges cash investors currently face

Cash management is no longer considered to be low risk. Cash management investments, particularly money market funds, have been subject to increased scrutiny from regulators globally. Cash investments are at the precipice of potentially major regulatory reform in Europe and have already been subject to changes in the United States. Investors have been affected by low interest rates and a shrinking supply of short-term securities. Regulatory change in the broader financial markets could lead to a direct impact in the cash market. For example, banks are increasingly turning away cash balances that adversely impact their Liquidity Coverage Ratio (LCR). This is a required metric introduced by Basel III regulations, in favour of stable balance, and deposit accounts with withdrawal notice.

Central bank policy has kept interest rates low globally resulting in money market instrument rates trending lower and in some cases, into negative territory. This presents a unique challenge for cash investors, many of whom cite preservation of capital as their primary objective. Many clients are looking for alternative solutions to traditional cash investments as a result of these conditions.

Despite these challenges, BlackRock believes there are strategies that cash investors can embrace to succeed in today's environment. These strategies include strong partnerships, more flexible and dynamic strategic cash allocations, enhanced governance and, above all, a comprehensive understanding of risks and opportunities. BlackRock offers insights into these strategies below.

So what do I do with my money? Understanding the options available to cash investors

Since the start of the financial crisis, the need for alternative cash solutions has increased and there is no longer a 'one-size-fits all' approach. Once thought of as a low risk asset class, the cash market may now be considered as multi-faceted, complex and subject to higher risk. The overarching objectives of risk-managed cash investing are still capital preservation and liquidity, but these can be applied differently across cash investment strategies. For all cash investments, BlackRock's approach is to apply rigorous credit and risk analysis. This approach has allowed cash clients to consider diverse investment options to meet their various needs. The following sections detail some of the options available today to cash investors, recognising that each client has unique liquidity needs.

Constructing an investment policy

Many treasurers are evolving their investment policies to be more dynamic and flexible to adapt to changing markets. It is prudent to review these policies regularly in order to embrace new opportunities and the evolving markets. An investment policy should define the overall objectives of the company's investment strategy and within this framework the following should be considered:

- Cash flow and liquidity needs. Effective forecasting of liquidity needs may help to increase returns over one-dimensional cash investing within a cash portfolio. A diverse investment approach may increase returns and reduce the cost of liquidity.

- Risk tolerance. It is necessary for an investor to determine their tolerance levels of interest rate and credit risk, and to assess what these mean for return volatility.

- Target returns and benchmark. Agreeing on a target benchmark will ensure the investment goals are well defined and clearly understood. Benchmarks should reflect the risk tolerance and the nature of the mandate.

- Permissible investments. An investor should identify the security types the mandate can hold and the rating limits that align with the mandate's risk profile.

- Diversification limits. Investors should articulate exposure limits to certain asset classes, sectors or individual issuers that are consistent with their risk appetite.

Cash segmentation policy

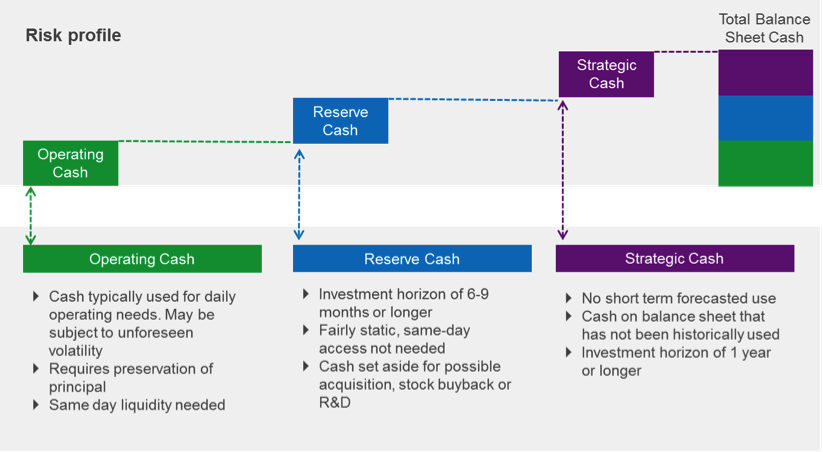

Given the prevailing market environment, liquidity will come at a premium. It is therefore important that cash investors conduct a thorough evaluation of their cash needs and determine their risk profile. Effective forecasting of liquidity needs and assessment of risk tolerance creates the opportunity to achieve higher levels of risk adjusted returns within a cash portfolio. Below is a sample strategy that demonstrates one such approach.

Investment options

AAA rated money market funds (MMFs) MMFs are mutual funds that invest in short-term debt instruments. They provide the benefits of pooled investment, allowing clients to invest in a diverse and high quality portfolio. Like other mutual funds, each investor in a money market fund is considered a shareholder of the investment pool. MMFs are managed within rigid and transparent guidelines to seek preservation of capital, liquidity and competitive yields and may have the following benefits.

- Diversification

MMFs invest in a wide range of issuers and money market instruments, adhering to the basic principles of portfolio management.

- Credit risk

AAA rated MMFs are required to adhere to rigid credit standards to ensure the portfolio is invested in high quality assets and represents an acceptable level of risk. Assets are ring-fenced from the investment manager and the investor's exposure is to the diversified underlying holdings.

- Liquidity

MMFs are designed to provide investors with daily liquidity, offering a flexible investment solution that requires no minimum commitment period or penalties for redemptions. Within the AAA rated MMFs space, there are funds that offer exposure to governments by investing in government paper and government backed repurchase agreements. There are also funds that invest in highly rated short-term money market instruments, often termed Prime Funds.

Unrated money market funds

Unrated MMFs provide investors with the opportunity to invest in a portfolio of, including but not limited to, similar high quality assets that are held in an externally rated MMF without the constraints of credit rating agency guidelines. Corporate treasurers typically look to the rating agencies for investment quality guidance. The rigid rating constraints placed on rated MMF portfolios may prevent managers from utilising the full MMF guidelines at their disposal. By simply removing the rating, a MMF is able to invest in the same securities but with a slightly longer duration or higher concentration. In a supply-constrained environment, this flexibility may translate into an increase in yield for investors.

Credit analysis and review is not absent in unrated funds. BlackRock's approach is to consider external ratings as a preliminary screen in our own independent credit review. BlackRock uses the ratings as a starting point in its assessment of an investment and they help BlackRock formulate its own independent credit opinion about an issuer or a specific investment instrument. Just as each rating agency may upgrade or downgrade issues, BlackRock's credit analysts apply an independent assessment of each security throughout the period that it is held.

Ultra Short Bond Funds

As part of the European Securities and Markets Authority (ESMA) guidelines, the most commonly used liquidity funds are referred to as 'Short-term Money Market Funds'. ESMA has also defined a set of guidelines for 'Money Market Funds' with a slightly longer duration. These funds are often known as Ultra Short Bond Funds and typically include the following features:

- Longer investment horizon than short-term money market funds (6-12 months)

- Fluctuating Net Asset Value (NAV)

- Maturity limits (fixed): 397 days

- Maturity limits (floating): 2 years

These funds may have the potential for higher returns as compared to short-term MMFs and often have a total return objective.

Separate accounts

Separate account strategies represent a unique way to achieve investment objectives for all types of cash. A separate account is a segregated portfolio of short duration assets managed by an investment manager on behalf of a client. A separate account differs from a MMF in that the investor directly owns the portfolio of assets rather than owning a share in a pool of assets. Separate account investors have the ability to customise the portfolio to their needs and investment guidelines while leveraging the trading, portfolio management and credit analysis of a professional investment manager.

Separate accounts are appealing to investors for a number of reasons, one being the possibility of obtaining a higher yield compared to that of a money market fund, but without a significant increase in risk. Working with an external investment manager offers significant benefits, most notably access to specialised credit, risk and portfolio management resources. It is the combination of these resources working to achieve a client's specific investment policy needs that represents the true value of investing in a separate account.

Comparing options: MMFs vs. Separate Accounts

| Money Market Funds | Separate Accounts |

|

|

Treasury outsource

Recognising that treasury teams are often relatively small and resource constrained, there is sometimes an argument to outsource certain treasury functions, one of those being the day-to-day investment activity. Outsourcing physical investment may provide the advantage of constant dialogue between a cash portfolio management team and issuers and brokers as well as the unique market access available to them.

Exchange traded funds (ETF)

As the market evolves, investors are increasingly forced to look outside the conventional treasury 'box' of investment products. Exchange traded funds (ETFs) are pooled funds which track an index and trade on an exchange, offering treasury investors a suite of investment opportunities.

ETFs provide investors with the opportunity to gain access and exposure to specific parts of the market, in a manner that is fully transparent and well diversified. Indices are constructed with clear and transparent parameters to represent the risk and return characteristics of a given sector or credit profile. In tracking a fixed income index, an ETF seeks to provide a more liquid and cost-efficient alternative to directly purchasing the bonds, which would achieve the same risk adjusted return. Treasury investors can utilise ETFs to gain specific market exposure to government or corporate bonds in the 0-5 year space, at a competitive price, whilst still maintaining attractive T+2 or T+3 liquidity.

Understanding the risks in cash investing

In today's complex and fast-changing markets, prudent risk management is more important than ever. Understanding the risks associated with an investment can help to ensure it is appropriate for each portfolio. A summary of the main risks inherent in cash investing is included below:

| Primary risks | Definition | Factors |

| Credit Risk | Risk that a security’s value will change due to a ratings downgrade or, in a distressed case, default of the security |

|

| Interest Rate Risk | Risk that a security’s value will change due to a change in interest rates or the shape of the yield curve |

|

| Liquidity Risk | Risk that arises from the difficulty of selling an asset; security cannot be bought or sold quickly enough to prevent or minimise a loss |

|

| Spread Risk | Risk of change in value of a security due to a change in the relative spreads in the market |

|

The role of an asset manager in cash investing

The term “asset manager” is often misunderstood. Asset managers act as fiduciaries to their clients by investing assets on their behalf. Asset managers invest within the guidelines specified by their clients for a given mandate. This will take into consideration the risk appetite of the client. As part of the financial services sector, asset managers are characterised by a business model that is fundamentally different than that of other financial institutions, such as commercial banks, investment banks, and insurance companies.

Asset managers do:

- invest on behalf of clients

- generally rely on a stable fee-based income stream

- have oversight and regulation at both the manager and mandate levels (in the US and EU regulatory regimes and elsewhere)

Asset managers do not:

- invest with their own balance sheets (other than seed capital or small co-investments)

- employ balance sheet leverage

- guarantee investor principal, and there is no government guarantee or backing

This material is for distribution to Professional Clients (as defined by the FCA Rules) and should not be relied upon by any other persons.

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: 020 7743 3000. Registered in England No. 2020394. For your protection telephone calls are usually recorded. BlackRock is a trading name of BlackRock Investment Management (UK) Limited.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy. This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2015 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, and BUILT FOR THESE TIMES are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. '