Building a Debt IR function: Difference between revisions

imported>Jeeten.patel@thinkpublishing.co.uk No edit summary |

imported>Doug Williamson m (Protected "Building a Debt IR function" ([edit=sysop] (indefinite) [move=sysop] (indefinite))) |

(No difference)

| |

Latest revision as of 12:54, 27 July 2015

| Treasury professional | |

|---|---|

| |

| Author | |

| Gillian Karran-Cumberlege | Fidelio Partners |

Introduction

For companies that are frequent issuers in the Debt capital markets the benefits of establishing a Debt Investor Relations (IR) function are now recognised. This commentary provides a framework for treasurers looking to establish the Debt IR function on a professional and effective basis. In this commentary we focus on IR in the context of the capital markets, as opposed to the fundraising function within private equity and hedge funds.

The history of Investor Relations

IR as a profession developed initially in the US capital markets and provided the interface between US corporates and their institutional equity holders. Over the past 25 years IR has become an established function globally, although with differing levels of maturity. IR also reflects the specific structures of local financial markets. For example, the IR profession in the UK reflects the distinctive UK tradition of a corporate broker also providing market intelligence and advice to the CEO. In contrast, in Germany IR teams are larger carrying out more activities in-house. Many of the changes in regulation of the financial services industry are also having an impact on IR even if IR is not the main focus of this regulation. Debt IR was much slower to evolve than Equity IR for a number of reasons. Whilst companies have cared deeply who is holding their equity, the relationship with debt investors was more distant. Traditionally the reporting requirements associated with servicing debt investors have been less onerous than with equity investors and debt investors were also historically less demanding than their equity counterparts. The Financial Crisis 2007/8 brought about profound change here. The systemic pressures focused attention on access to liquidity and the subsequent low interest rate environment made debt funding attractive, in particular for strong corporate names. Since 2008 the majority of large quoted and some unquoted companies have established a Debt IR capability. The requirement for the banking system to substantially increase levels of capital adequacy has driven very high issuance levels in the banking sector. As a consequence the specialist skills and expertise associated with Debt IR are increasingly recognised.

The goals of Investor Relations

As a working definition, IR is the corporate function which provides investors with the information they require to make investment decisions. It is also involved in the identification of new investors and subsequent outreach. IR (both Equity and Debt) clearly has financial goals related to a fair valuation and reducing the cost of capital and funding. There are also broader reputational benefits of an effective IR programme, which are set out in the table below.

| Specific Financial Goals | Broader Communication Goals |

| A fair market valuation | Raising of corporate awareness |

| A reasonable level of liquidity in the company’s equity and debt | Enhancement of corporate image |

| Easier and cheaper access to capital and funding in future | Generate premium |

| Stable share price and investor structure | Strength of brand |

| Takeover protection / flexibility to acquire | Strategic endorsement |

| Source: Fidelio Partners | |

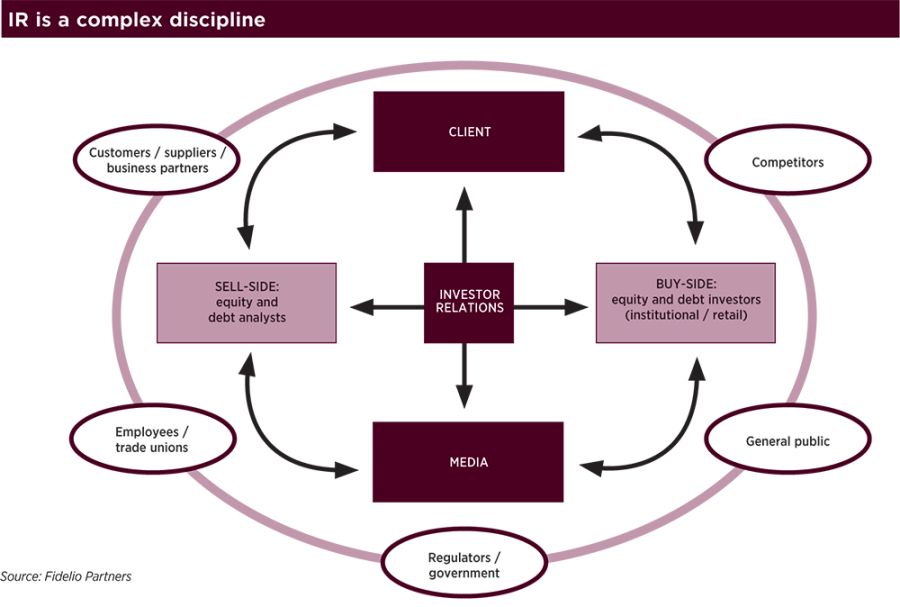

The clients of Investor Relations

Clearly the Debt IR function is established to service the requirements of fixed income investors. Post-2008 there is a greater awareness of the range of stakeholders which are critical for any business and also how these stakeholder groups interact. Clearly communication with investors must be within the appropriate disclosure requirements. Communication to various stakeholder groups must also be consistent. It is certain that discrepancies between what is communicated to debt and equity investors will be rapidly identified by the market. A Debt IR officer must also be sensitive to the impact that communication to investors may have on employees or customers, for example. Experienced CFOs and treasurers recognise that for a large quoted corporate, in particular, there are multiple points of contact with the capital markets. It is important to ensure consistency of message across all investor groups. The simplest way of achieving this is for one team to be tasked with producing the core investment message. This material will then be used as the key building block for all communication with key investor groups in particular those set out below:

- institutional equity investors;

- institutional debt investors;

- fixed-income or equity analysts (buy or sell-side);

- retail equity or bond investors;

- employee shareholders;

- bank lenders;

- commercial paper investors;

- financial journalists; and

- rating agencies.

The IR function is ideally positioned to take on the task of crafting the corporate investment case. This also serves an important compliance requirement helping to ensure proper disclosure, in particular around sensitive topics such as corporate outlook.

When to establish a Debt IR function

There is no hard and fast rule as to what size of funding programme warrants a dedicated Debt IR function. For companies that are infrequent issuers, it is typical and most economical for the treasurer and treasury team to manage the issuance process and also to act as the point of contact for investors For more frequent issuers, however, two key questions need to be addressed:

- Has the issuance programme grown to a scale that it requires dedicated resource to handle the interaction with debt investors?

- Can a dedicated Debt IR team contribute to a more effective issuance programme thereby improving access to the markets, as well as reducing the cost of funding?

If the answer to either question is yes, then the treasurer should consider a Debt IR function.

The transferability of Equity IR expertise to Debt IR

Frequently Debt IR will be established within an existing Equity IR function. A Debt IR programme must have the technical expertise to address the specific questions of fixed income investors relating to the instruments that they have invested in. There are also some strong elements of similarity between Debt and Equity IR. Investors have an interest in the health of the company. Therefore, both Debt and Equity IR must present an investment case for the company and not just the underlying securities. Thoughtful investors will be interested in the overall capital and funding structure of the company. If skills, experience and processes are already in place to service equity investors, the treasurer should look to Equity IR as a starting point and avoid re-inventing the wheel.

Deliverables for Debt IR

When structuring a Debt IR function, it is helpful to have a clear understanding of the following deliverables:

- Servicing the information requirements of existing fixed income investors.

- Marketing of new debt issues. This includes preparing materials and also participating in road shows.

- Building up long-term and non-deal relationships with key investors.

- Building up an understanding of the potential investor universe. This can support decision-making on Corporate Finance and capital market activity. It can also provide the basis for investor targeting.

- As appropriate, providing internal education to colleagues about the debt markets and debt investors.

Skill sets

Based on the above criteria, the treasurer establishing a Debt IR function should look for the following skills:

- A technical understanding of the debt instruments which have been or are being issued, as well as a working understanding of the debt capital markets. This includes an understanding of the regulatory framework.

- The ability to answer a range of questions relating to corporate performance and credit worthiness. A key element is a firm grasp of financial reporting.

- Communication skills. An important aspect of the Debt IR role is the ability to communicate complex messages.

- Strong interpersonal skills.

- Team player. Effective Debt IR will require collaboration across a number of functions.

Structure of the team/reporting lines

The structure of the Debt IR function is clearly company specific. Regardless of the reporting line, Debt IR requires very substantial input from the treasurer and the treasury function. Thus there needs to be a dotted reported line or at least a very open and effective relationship between Debt IR and treasury. This works most smoothly when IR and treasury are both part of the finance function. When IR sits within the communications or corporate affairs function, at times the flow of information with colleagues in the finance function can be more problematic and more thought needs to be given to promote co-operation. A typical division of labour between Debt IR and treasury is as follows:

- Treasury contributes the technical expertise relating to bond issuance programmes.

- IR contributes the corporate expertise, as well as the experience of marketing the corporate investment case.

- Ownership of the relationship with the investors and with the rating agencies needs to be clarified. A pragmatic approach is recommended.

In larger corporates we are also seeing evidence of increasingly structured co-operation between treasury, Debt IR and corporate finance. This recognises that all three functions have distinct contributions to make in securing long-term and sustainable access to equity and debt thereby ensuring liquidity, solvency and capital adequacy.

How to measure the success of Debt IR

A treasurer establishing a Debt IR function should rightly be concerned about how to measure success. At best an effective Debt IR team reduces the cost of capital. This contribution is hard to isolate and therefore hard to measure. The same challenge faces the CFO in measuring the contribution and success of Equity IR. However, a roster of KPIs has been developed for Equity IR which we consider to be broadly applicable to Debt IR and which we set out below. The KPI relating to stock performance can be replaced by metrics relating to maintaining the attractiveness of the corporate’s debt in the market. The other metrics shown in the table offer a simple method of monitoring performance and provide relevant tools for promoting effective and professional Debt IR.

| Typical KPIs to measure IR performance | |

|---|---|

| KPI measurement | Ranking |

| Interaction with management | 29% |

| Quality of investor meetings | 26% |

| Message absorption / quality of sell-side reports | 24% |

| Investor outreach / number of meetings | 24% |

| Company stock performance in a given year | 23% |

| Ability to attract new investors | 18% |

| Quality of investor base | 15% |

| Number of analysts covering the company | 9% |

| Source: BNY Mellon, Global Trends in Investor Relations, October 2011 | |

The conclusion

The Debt IR function plays an important role in ensuring sustainable access to the debt capital markets and thereby improving the cost of funding. Debt IR draws upon a range of skills and to be effective relies on input from a number of internal departments. The treasurer looking to establish an effective and professional Debt IR function does not need to re-invent the wheel. We argue that much of the discipline and practice of Equity IR can be transposed to Debt IR. Debt IR has now become an established profession. Success will be determined by the ability of the Debt IR officer to service existing investors, source new investors and potentially new pools of funding and at the same time contribute to an increase in stakeholder value. There is clearly much to play for.