Treasury performance management – waste of time or a necessity?

| Treasury professional | |

|---|---|

| |

| Author | |

| Daniel Perkins |

Principal, Treasury SME, CTP, Accenture |

Introduction

"If you cannot measure it, you cannot improve it."

"To measure is to know."

Two quotes from Lord Kelvin back in the 19th century seem apt for performance measurement. Treasury is one of the financial functions that historically has been difficult to measure. Its services provide large qualitative benefits and the processes, such as cash and financial risk management, are entwined with other functions and business units. For other operational functions, KPIs and targets are often already in place:

- Sales forces are measured on revenue they produce and the leads they convert into sales.

- Production plants have a variety of measures including production costs and defect per million units.

- Finance departments are measured on time to report from month-end close, errors per invoice processed and working capital measures such as DSO and DPO.

Treasury performance has become more important following the recent credit crisis, and business analytics and metrics for finance functions are increasingly expected by senior management.

Why: Should organisations measure treasury performance?

Is measuring treasury performance worth the effort? After all, treasuries are not generally profit centres and they are not factories producing tangible items, so why should organisations expend effort on measuring their performance? Listed below are some reasons why:

- Need for control: The treasury function is responsible for high-value, time-critical transactions that can be complex in nature.

- Risk reduction: The function is often responsible for managing financial risks (foreign exchange, interest rates and liquidity risk), counterparty and operational risks. Established metrics are available for market risks whereas the operational and credit risk are still hard to measure.

- Process improvement: Before a process can be managed, information is needed about the input and the outputs of the process. With this information processes can be re-engineered and metrics can be developed to monitor how well they are run over time.

- Demonstrate value to organisation: Treasuries are generally under-resourced and often this is due to their inability to demonstrate their value to the organisation. By actively measuring treasury performance, senior executives can grow to realise its value and provide the resources required to support the function properly.

Increasingly, analytics are being used in the finance function and treasury should not be the exception to the rule. The treasury function often takes the lead in innovation, embracing technology and the latest thinking so why not performance measurement? Metrics are not new to the treasurer: credit ratings and covenant ratios are well known.

How: Approach for measuring performance

Performance management can be approached from both a quantitative and qualitative viewpoint. The preference in finance is to focus on the “hard” quantitative measures. For those measures it is important to understand:

"The more you understand what is wrong with a figure, the more valuable that figure becomes." (Lord Kelvin)

The softer measures should not be overlooked and can be even more important.

Quantitative approach

The first question is what type of metrics are useful and how do you benchmark these? A common method is to use ratios which can be used to determine the relative efficiency of a process, such as number of staff per unit of revenue (or volume of transactions). Other measures compare process effort times to complete an operation i.e. time taken to produce the cash position (per business unit). These statistics can then be compared over a set time period to identify trends in the process. They can also be used to compare how efficient the business units are relative to each other. There are many metric types that can be used (see Figure 1). Portfolio type and Value at Risk measures tend to be used by the financial institutions.

Too many measures can lead to confusion. What is important is to identify the key drivers for the treasury function. Whether it is debt, liquidity or departmental cost. It is important to recognise that the quality of an indicator is only as good as the information it is based on and so reliance on pure numbers needs to be treated with caution.

One area where measures can be very beneficial is in cash forecasting. When this is measured and incentives are placed on forecast accuracy, a marked improvement can often result.

Qualitative approach

An alternative and complementary method is to use non-quantitative methods such as scales of performance, surveys or just a pure judgemental view of performance. These measures can be assigned values on a scale, but they are still subjective. A good example is to measure a process on a scale of low to high performance. Due to a changing environment and technology, process efficiency should improve over time and hence the scoring needs to take this into account. Another approach is to use the upper quartile as the benchmark for high performance and compare the top performers and identify what they do differently. This can be extended to look at external benchmarks too.

Metric framework

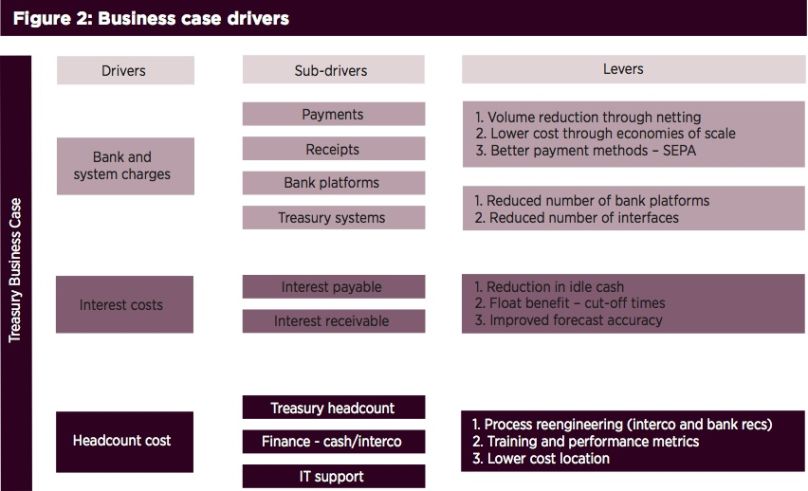

When establishing the framework for measuring the performance of the treasury function the first step is to identify the value levers that drive the contribution treasury makes to the organisation. Treasury needs to take a step back and determine what the organisation seeks from the treasury and how it can meet those needs. This must be done in discussion with the CFO, business units and other relevant parties. This is not a simple exercise and there is no standard checklist as every organisation is different, with different pressures, markets and competitors. But the importance of spending time on it cannot be overstated. An example of the metrics used by global corporate treasuries can be seen in a benchmarking survey completed by Accenture in 2012. Of the 128 large companies from 19 industries surveyed, 45 had headquarters in Europe, 45 in North America, 32 in Asia and six in South America. From this analysis, treasury will be able to determine the objectives that need to be set to deliver this value and from this the necessary metrics will follow. Figure 3 provides a comprehensive list of some metrics that are used.

| Figure 3: Metric framework | |||

|---|---|---|---|

| Functional Metrics | Value Lever | Objectives | Metrics |

| General Metrics | Headcount costs Performance |

Efficient treasury operations Cost reduction BU satisfaction levels |

Treasury cost per revenue (bn)

Performance against budgets |

| Cash Management

Metrics |

Cost of borrowing Interest earned Investment returns on excess cash |

Optimise cash management

Reduce bank fees

Optimise investment income

Reduce debt/equity expense |

Idle cash % month over month Paper/electronic payment % Cash balances % /B of revenue % cash pooled by currency vs non pooled cash Bank fees % revenue % return on investment short and long term vs market rate Cost of borrowing vs market rate |

| Risk Management

Metrics |

Cashflow and earnings volatility Cost of hedging Risk/return ratio |

Risk identified and managed effectively to policy framework | Exposure accuracy Hedge ratio breaches Hedge rate achieved vs benchmark Net hedging costs Profit at Risk & VaR, RAROC Portfolio return Hedge effectiveness |

| Employee Metrics | Business capability, retention and development |

Ensure capability Maintain satisfactory staff morale Deliver against targets |

Staff satisfaction levels (survey) Staff turnover % % absenteeism per month Performance against objectives |

| Process Metrics | Process efficiency and effectiveness Data Quality Compliance |

Process standardisation, automation and elimination Lower headcount Improve information quality and timeliness |

Reporting breaches Policy or Limit breaches Error rates IT helpdesk statistics Process benchmarking Number of redundant processes |

Year-on-year or quarterly comparisons can be made. The starting year or quarter can act as the baseline for a reward programme to treasury functions and its employees, when an agreed level is reached in the next period.

Process framework

When establishing the framework for measuring the process performance of the treasury function, it is important to identify the critical processes for the organisation. To identify these processes, the treasury department should review all individual processes and evaluate how the current process would rate on a low performance, medium performance and high performance scale. An example of some cash management processes is also detailed in Figure 4.

| Figure 4: Cash management sample processes | |||

|---|---|---|---|

| Process | Low performance | Medium performance | High performance |

| Obtaining bank balance and transaction information | Paper bank statements still used for reconciliation

Multiple electronic banking systems used |

Reduced number of electronic banking systems | SWIFT connectivity used for obtaining transaction and balance information from multiple banks |

| Centralising available liquidity | Many bank accounts used for sending and receiving payments | Some in-country pooling used Plans to roll out cross-border pooling | Use of both notional and cash concentration structures High visibility of cash and awareness of country restrictions |

| Management of idle cash | There are potentially large sums of idle cash in bank accounts but this is not reported | Idle cash is identified and in-country measures are implemented to improve interest earned | Idle cash is moved to central locations to be used efficiently where restrictions allow |

| Cash forecasting | Cash forecasting is not completed or is not measured | Cash forecasting is measured but the accuracy is poor (>20% variance for the weekly forecast) | Cash forecasting is measured for daily, weekly and monthly time periods and incentives are in place |

| Banking fee monitoring | There is no central control on the banking fees paid | Every year there is a review of the banking fees paid to the banks | Bank fees are managed centrally with at least quarterly reviews |

One example of technological change and its effect on processes is the collection of bank information.

- Thirty years ago, payments were reconciled using paper-based bank statements and were received by regular mail. This was time-consuming and very expensive, but was still quite an efficient process at that time.

- Fifteen years ago, electronic banking became available allowing bank statements to be downloaded. Statements were imported into the ERP system.

- Nowadays, electronic bank statements are received directly from the executing bank via a SWIFT connection, allowing for full automation of reconciliation of payments.

Using the information shown in Figure 5, the performance of the treasury process can be measured, by positioning the process on the low, medium and high performance scales. Based on the results from the analysis, future goals can be set by senior management to improve performance even further.

Client example

An international company has divisions in the regions Asia (HQ), Europe, North and South America and Africa. The company wanted to improve its treasury cash management processes and utilise the latest technology available. Two related key processes were highlighted for improvement:

- obtaining bank balances and transaction data; and

- centralising liquidity. See Figures 5 and 6.

| Figure 5: Obtaining bank balance and processing transaction information | |||

|---|---|---|---|

| Low performance | (1-Current) Medium performance | (2-Desired) High performance | |

| Bank statements are downloaded manually | Bank statements are automatically downloaded locally | Bank statements are downloaded automatically on central location | |

| Bank-specific application or website is used | Bank-specific application or website is used allowing automated download | SWIFT for Corporates is used to receive the bank statements directly from the bank | |

| Bank reconciliation is carried out on a weekly basis | Bank reconciliation is carried out on a daily basis in accordance with the bank statements | Bank reconciliation is carried out in real time when bank statements are received | |

| Figure 6: Centralising available liquidity | |||

|---|---|---|---|

| Low performance | (1-Current) Medium performance | (2-Desired) High performance | |

| Standalone cash balances at the local entity level | Local cash pooling structures available where legally allowed | Cross-border cash pooling structures in place where allowed | |

| Lack of group-level cash balance transparency | Cash pooling structures for increased level of cash transparency | Centralised cash position on a daily basis with drill-down ability | |

| Weekly information on cash positions | End-of-day information on cash positions | Real-time information on bank balances for cash | |

Bank balances and transaction data

In the old situation bank account reconciliation was carried out on a weekly basis and the payments were reconciled manually. The data from the banks was obtained from the various electronic banking systems but it was manual and time-consuming. After the analysis, the decision was made to use SWIFT to receive bank account transaction data centrally and distribute this information over the Group entities using other tools.

Centralising available liquidity

In the old situation the company has many bank accounts across the Group with idle cash. The total cash position is not calculated daily as the information is not centrally available. The company wanted to gain daily cash visibility at Group level to improve the availability of cash and the interest cost/income.

Organisational size and complexity

The impact of improving process efficiency and effectiveness for organisations differs by the global coverage of the organisation and the complexity of the business operations. For large global organisations the benefit of moving toward high performance can be much greater than for medium or smaller organisations. This is mainly caused by the volumes, economies of scale and having a budget to invest in technology. However, this does not mean that smaller treasury functions should not strive to improve their processes and invest in technology. Treasury can sometimes be the first mover in finance transformation and a catalyst for change in the finance function as a whole. For all companies, a business case can be created to check whether there is benefit in moving up the scale towards high performance or confirmation that the existing processes are sufficient for the time being.

Conclusion

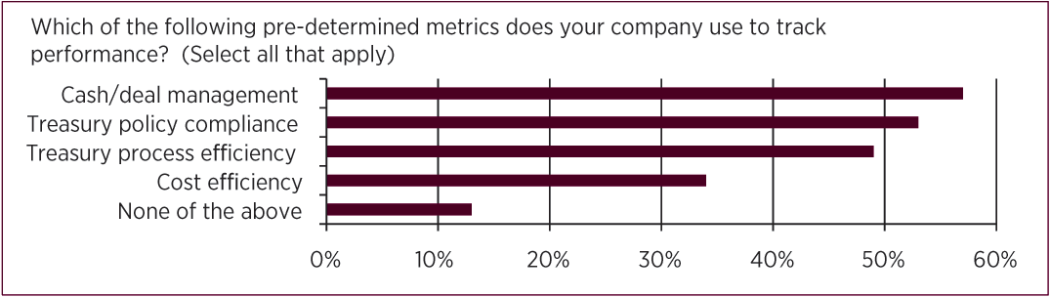

Measuring the performance of the treasury function is not a simple task. What should be measured, what should they be compared to, and how is fairness ensured? The treasurer is already focused on external metrics such as credit ratings and covenant ratios; extending this to a select number of internal metrics should not be too big a step. In Figure 7 we can see that a vast majority of the companies surveyed have established quantitative metrics in the areas of: cost efficiency, cash/deal management, treasury process efficiency and treasury policy compliance. As business analytics grows in importance and the treasury function remains high profile, this provides an opportunity to demonstrate progress and the value that the function contributes to the organisation. This in turn should assist in securing more internal investment in the treasury function.

| Figure 7: The majority of companies use a variety of pre-determined metrics to track their treasury function's performance |

|---|

|

Reasons why it is important for treasuries to measure performance:

|

Functional Metrics | Value Lever | Objectives | Metrics |

| Cash Management Metrics | Cost of borrowing Interest earned Investment returns on excess cash |

Optimise returns & minimise cost of borrowing |

| |

| Policy Compliance | Data Quality Compliance | Improve information quality |

| |

| Treasury Process Efficiency | Process efficiency & effectiveness | Process standardisation, automation and elimination |

| |

| Cost Efficiency | Headcount costs Performance | Efficient treasury operations

Cost reduction |

|