Changes to IFRS and convergence with FASB present challenges for treasurers

| Corporate finance | |

|---|---|

| |

| Authors | |

| Chen Voon Hoe | Partner, PricewaterhouseCoopers LLP, Singapore |

| Senthilnathan Sampath | Associate Director, PricewaterhouseCoopers LLP, Singapore |

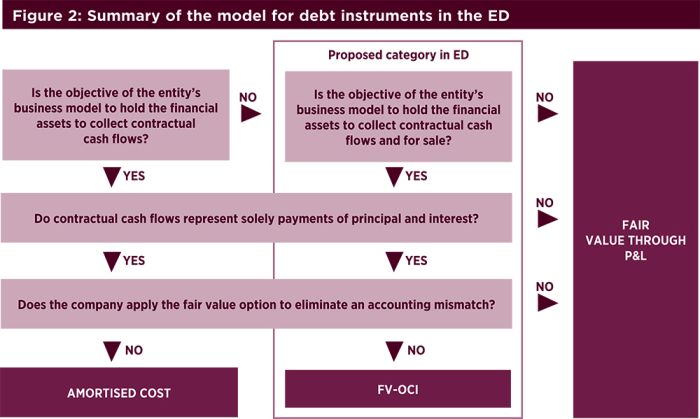

IASB workplan

The International Accounting Standards Board’s (IASB) work plan included a very full agenda with many projects scheduled to be delivered by October 2014 (Figure 1). Two important milestones were achieved by IASB in 2014 with the issuance of Revenue Recognition and final requirements being issued on the impairment chapter of Financial Instruments. Other projects being handled by IASB include Leases, Insurance Contracts, Business Combinations as well as Macro Hedging.

Status of IFRS transition process around the world

According to IASB, IFRS as an accounting framework is globally adopted or permitted by almost 120 countries. All remaining major economies have established timelines to follow in the near future.

Unlike Europe, where IFRS has been largely adopted by most countries across the European Union, the extent to which Asia has adopted IFRS varies from country to country. Countries like Hong Kong and Korea have adopted an accounting framework that is identical to IASB IFRSs. India has recently proposed for mandatory adoption of the new Indian Accounting Standards (Ind AS), which are substantially converged with IFRS to be implemented from financial year 2016-2017.

However, a prevailing trend among a number of the Asian economies is the selective adoption of the principles of IFRS into their local GAAP. These economies have either amended or have not adopted IFRS standards that do not harmonise with their national laws or accounting practices. China, for example, has aligned its new Chinese Accounting Standards (CAS) with the substance of IFRS rather than a direct adoption of IFRS. Other economies, which include Singapore, Philippines, Malaysia and Taiwan, have excluded certain elements or standards in the IFRS framework from their local GAAP.

In economies such as India and Japan, where IFRS has not been adopted as the reporting basis, the IASB has stepped up its discussions on IFRS convergence with local standard setters. However, progress seems to be slow.

IFRS 9 Financial Instruments – Replacement of IAS 39

During the financial crisis, the G20 tasked global accounting standard setters to work intensively towards the objective of creating a single high-quality global standard. As a response to this request, the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) began to work together on the development of new financial instruments standards. The IASB decided to accelerate its project to replace IAS 39, and sub-divided it into three main phases: classification and measurement; impairment; and hedging. Macro hedging is being considered as a separate project. The final requirements for classification and measurement and impairment are completed effective for annual periods beginning on or after 1 January 2018.

The IASB completed the first phase of this project (classification and measurement) for financial assets in November 2009 and for financial liabilities in November 2010. In late 2011, the IASB decided to consider limited amendments to the classification and measurement model in IFRS 9, and published the exposure draft (ED) on these limited amendments at the end of November 2012. Deliberations on these limited amendments were finalised in February 2014 and it was issued as a standard in July 2014. As part of this project, the IASB issued its first impairment ED in 2009. At that time, the IASB proposed that an entity should measure amortised cost at the expected cash flows discounted at the original credit-adjusted effective interest rate. As a result, interest revenue would be recorded net of the initial expected credit losses. Although constituents supported the concept, they raised serious concerns about its operationality. The IASB subsequently developed the three-bucket model and the feedback supported a model that differentiates between financial instruments that have suffered a significant deterioration in credit quality since initial recognition and financial instruments that have not. Based on the feedback received, the IASB further modified the three-bucket model proposals, in particular, the requirements as to when a financial instrument’s loss allowance should be measured at an amount equal to lifetime expected credit losses.

For the third part of the project – hedge accounting, the IASB has issued a review draft (RD) that details the new hedge accounting requirements. The RD relaxes the requirements for hedge effectiveness assessment and consequently the eligibility for hedge accounting. Under IAS 39 today, the hedge must both be expected to be highly effective (a prospective test) and demonstrated to have actually been highly effective (a retrospective test), with ‘highly effective’ defined as a ‘bright line’ quantitative test of 80-125%. The RD replaces this with a requirement for there to be an economic relationship between the hedged item and hedging instrument, and for the hedged ratio of the hedging relationship to be the same as the quantity of the hedged item and hedging instrument that the entity actually uses for its risk management purposes. An entity is still required to prepare contemporaneous documentation to support hedge accounting. In addition, hedge ineffectiveness must still be measured and reported in the profit or loss. This has been published in the November 2013 issuance of IFRS 9.

The IASB has decided that the requirements of IFRS 9 would be effective from the start of 2018. Accounting standards Council of Singapore has also adopted IFRS 9, with an effective date rom 1 January 2018.

The EU has not yet endorsed IFRS 9, thereby precluding IFRS reporting entities within the EU from adopting the standard early.

Phase 1 – IFRS 9 Financial Instruments: classification and measurement

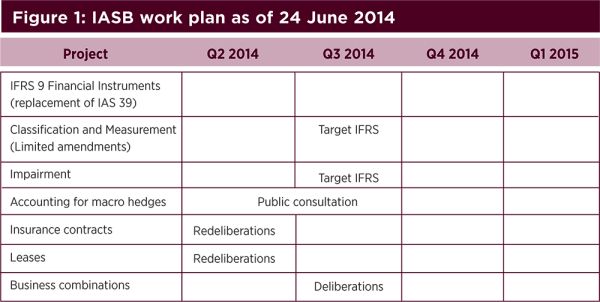

IFRS 9 replaces the multiple classification and measurement models for financial assets in IAS 39 with a model that currently has three classification categories: amortised cost, fair value through profit and loss (FVTPL) and fair value through other comprehensive income (FVOCI). Classification under IFRS 9 is driven by the entity’s business model for managing the financial assets and the contractual cash flow characteristics of the financial assets.

IFRS 9 removes existing IAS 39 categories, notably the held-to-maturity and available-for-sale categories and the tainting rules associated with the former, and the requirement to separate embedded derivatives from financial asset hosts. Hybrid financial asset contract now needs to be classified in its entirety at either amortised cost or fair value.

If the financial asset is a debt instrument, entities should consider whether both the following criteria are met:

- Business model test: The objective of the entity’s business model is to hold the asset to collect the contractual cash flows;

- Contractual cash flows test: The asset’s contractual cash flows represent solely payments of principal and interest.

If both these tests are met, the financial asset falls into the amortised cost measurement category. If the financial asset does not pass both tests, it is measured at FVTPL or FVOCI (see Figure 2).

- IASB has now defined the business models for classification and measurement of debt investments as follows:

- Amortised cost: Consists of debt investments in order to collect the contractual cash flows.

- FVOCI: Consists of debt investments which are managed both in order to hold to collect contractual cash flows and to sell them.

- FVTPL: Consists of debt investments that are not measured at amortised cost or at FVOCI.

The FVOCI category is intended to acknowledge the practical reality that entities may invest in debt instruments to generate yield but may also sell if the price is considered advantageous or it is necessary to periodically adjust or rebalance the entity’s net risk, duration or liquidity position. Entities will need to carefully assess the overall business objective to determine whether their portfolios of financial assets are more aligned with this new FVOCI business model (hold to collect and to sell) or that of a amortised cost business model (hold to collect) or whether they fall in the residual FVTPL category. Business models for such portfolios can vary widely and hence judgement will be needed to evaluate the factors for each individual portfolio.

For the investments in equity instruments (that meet the definition of equity as defined in IAS 32 from the perspective of the issuer) they are always measured at fair value. Equity instruments that are held for trading are required to be classified as at FVTPL. For all other equities, management has the ability to make an irrevocable election on initial recognition, on an instrument-by-instrument basis, to present changes in FVOCI rather than profit or loss. If this election is made, all fair value changes, excluding dividends that are a return on investment, will be reported in other comprehensive income (OCI) (see Figure 3). There is no recycling of amounts from other comprehensive income OCI to profit and loss – for example, on sale of an equity investment – nor are there any impairment requirements. However, the entity may transfer the cumulative gain or loss within equity.

Other changes to the existing guidance on financial assets in IAS 39 are as follows:

Cost exemption for unquoted equity instruments

The exemption for unquoted equities and derivatives on such unquoted equities has been removed. At the same time, the Board has stated that under limited circumstances cost may be an appropriate estimate of fair value. That may be the case if more recent information available to determine fair value is considered insufficient, or if there is a wide range of possible fair value measurements and cost represents the best estimate of fair value within that range.

The standard provides a list of indicators where cost might not be representative of fair value. The list is not exhaustive and treasurers will need to use all information about the performance and operations of the investee which will become available after the date of initial recognition. To the extent that any such relevant factors exist, they may indicate that cost might not be representative of fair value and treasurers must estimate fair value.

Embedded derivatives in financial assets

A hybrid contract is required to be classified in its entirety at either amortised cost or fair value. Complex rules regarding split accounting of hybrid contracts is no longer required. This reduces the burden on treasurers especially with respect to determining fair values for the embedded derivatives. Going forward, most hybrid contracts with financial asset hosts will therefore be measured at fair value in their entirety. However, hybrid contracts with financial liability hosts will still remain within IAS 39 rules concerning the separation of embedded derivatives.

In addition, the IASB decided not to permit bifurcation for financial assets but requires bifurcation of financial liabilities. For IFRS this decision means that the principle in IFRS 9 is affirmed. As a consequence, such financial assets would be classified as a whole at fair value through profit or loss as it contains cash flows that are not solely principal and interest. Hence, going forward there would still be an asymmetry in accounting for financial assets and financial liabilities.

IFRS 9 does not change the basic requirements for classifying and measuring financial liabilities. However, under the fair value option, specific treatment is required for addressing the effects of changes in the credit risk of financial liabilities. Going forward, for all financial liabilities designated under the fair value option, changes in the liability’s credit risk should not affect profit or loss. Instead, these changes should be presented in other comprehensive income.

Reclassification of the amounts presented in other comprehensive income is prohibited. Treasurers should note that the implication of this guidance would reduce volatility in profit or loss. However, the entity is still required to identify and isolate changes in fair value attributable to the credit risk of the respective financial liability.

All entities will be affected by the new classification and measurement requirements introduced by IFRS 9, but the degree of the impact will depend on the type and significance of financial instruments held by the entity and the entity’s business model(s) for managing these financial assets.

Phase 2 – Financial instruments: Amortised cost and impairment

IASB issued the exposure draft on impairment of financial instruments on 7 March 2013 with the comment period ending on 5 July 2013. The final requirements were issued in July 2014.

Following several years of discussions and two previously published proposals, the IASB has issued IFRS9, ‘Financial Instruments: Expected Credit Losses’. The IFRS 9 expected loss impairment model will replace the current incurred loss model of IAS 39. The standard addresses the criticisms of ‘too little, too late’ that arose during the recent financial crisis. So it is expected that impairment losses will not only be larger but will also be recognised earlier.

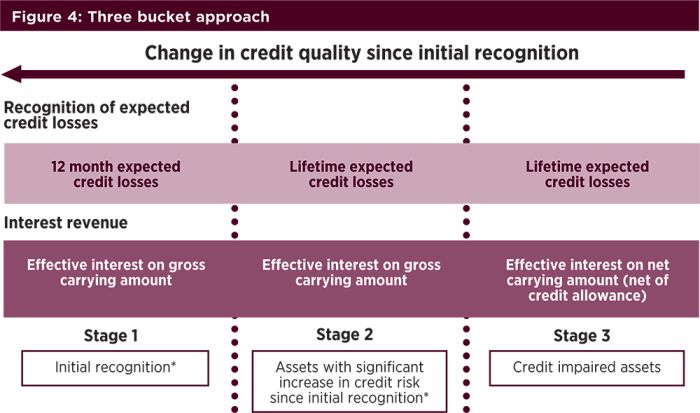

Under the standard, an entity should recognise an impairment loss equal to 12-month expected credit loss; or if the credit risk on the financial instrument has increased significantly since initial recognition, it should recognise a lifetime expected credit loss (see Figure 4).

Expected credit losses are determined using an unbiased and probability-weighted approach and they take into account the time value of money. The calculation is not a best-case or worst-case estimate; rather, it should incorporate at least the probability that a credit loss occurs and the probability that no credit loss occurs.

When determining whether lifetime expected losses should be recognised, an entity should consider the best information available, including actual and expected changes in external market indicators, internal factors and borrower-specific information.

Where more forward-looking information is not available, delinquency data can be used as a basis for the assessment. But, in this case, there is a rebuttable presumption that lifetime expected losses should be provided for if contractual cash flows are 30 days past due.

An entity does not recognise lifetime expected credit losses for financial instruments that have low credit risk at reporting date.

Interest income is calculated using the effective interest method on the gross carrying amount of the asset. But, once there is objective evidence of impairment (that is, the asset is impaired under the current rules of IAS 39), interest is calculated on the net carrying amount after impairment.

As for disclosures, there are various requirements including reconciliations of opening to closing amounts and disclosure of assumptions and inputs.

The standard is effective from annual periods beginning on or after 1 January 2018. The standard is to be applied retrospectively; but restatement of comparatives is not required.

The impairment provisions in the standard may likely lead to increase in impairment losses due to recognition of lifetime expected losses upon initial recognition and this may lower the return on equity ratio.

Phase 3 – Financial instruments: Hedge accounting

Hedge accounting was one of the areas of major concern to treasurers in the past. The objective of the current proposals is to reduce the detailed rules that make hedge accounting under IAS 39 complex and costly and to better align hedge accounting to risk management practices. The key proposals include:

- relaxing the requirements for hedge effectiveness and consequently the eligibility for hedge accounting;

- removing certain restrictions around what can be designated as a hedged item; and

- relaxing the rules on using purchased options and non-derivative financial instruments as hedging instruments.

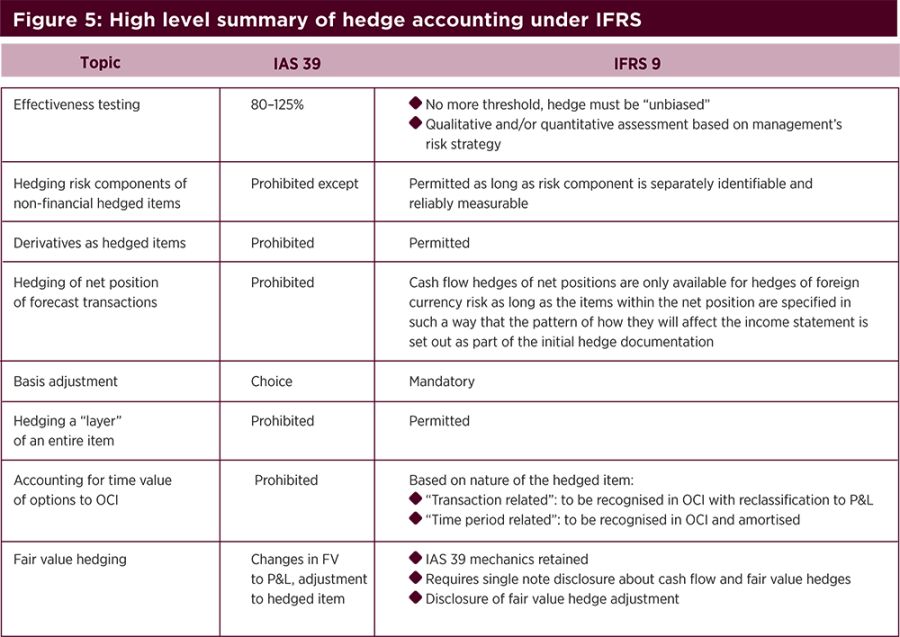

The International Accounting Standards Board (IASB) has issued a final standard on the general hedge accounting model in November 2013. The general hedge accounting model will have, among others, the changes shown in Figure 5.

The standard would not be mandatory until 2018. Entities in Singapore would be able to early adopt the new hedge accounting rules as they are endorsed by the Accounting Standards Council. To early adopt the standard, entities will need to early adopt the existing piece of IFRS 9 on classification and measurement. For most entities, this would not be a drawback.

Hedging relationships that have qualified for hedge accounting in accordance with IAS 39 that also qualify for hedge accounting in accordance with the criteria of this review draft shall be regarded as continuing hedging relationships.

Prospective application of the proposed hedge accounting requirements would be applied for all hedging relationships. This approach would resolve the problem of having to apply two models simultaneously.

This means that on the date of transition all existing hedging relationships should be moved from the existing model under IAS 39 into the new proposed model. But there will be no restatement of comparatives. This approach would allow some one-off transitional provisions to ensure that ‘qualifying’ hedging relationships could be moved from the existing model to the proposed model and would therefore be subject to the proposed requirements from the adoption date.

The treasurer shall consider the impacts of the expected standard, and how it can benefit the overall risk management approach by bringing alignment between the optimal risk management strategy and the accounting outcome. In the past, an unfortunate consequence of the existing standard is that in some cases, the preferred economic hedging approach has not been achievable due to the accounting restrictions.

With local and global economic conditions increasingly volatile and some important accounting restrictions removed, this represents an ideal opportunity for companies and the treasurer to revisit the risk management strategy, with greater confidence as to the alignment of the ultimate accounting outcome.

Exposure draft, leases

On 16 May 2013, after more than two years of deliberations, the IASB and FASB issued a revised exposure draft (ED) of a standard for leases.

This ED attempts to address many of the criticisms of the 2010 ED. At a high level, the proposed model appears simpler to apply than the previous proposals. But this might underestimate the impact of having to identify and recognise assets and liabilities in respect of all leases, as well as the need to re-think which accounting model to apply to different types of lease.

Lessee accounting

Consistent with the 2010 proposals, the ED eliminates off balance sheet accounting for lessees. The balance sheet distinction between operating and finance leases is removed, and a new asset (representing the right to use the leased item for the lease term) and liability (representing the obligation to pay rentals) are recognised for all leases (except short-term leases – see below).

The definitions of ‘lease term’ and ‘lease payment’ have changed since the 2010 ED. The lease term will include optional extension periods only where there is a significant economic incentive to extend. Lease payments used to measure the asset and liability will exclude contingent rents that vary on the basis of usage or performance (such as sales from a retail store or distance flown by an aircraft). These bases of measurement will result in lower carrying values for lease assets and liabilities than those under the 2010 proposals, and are not significantly different from current accounting for finance leases under IAS 17.

Probably the most significant change since the 2010 ED (although it represents less of a change from current requirements) was that the boards proposed two different expense recognition patterns for different types of lease: some (termed ‘type A’ leases) will apply the approach proposed in 2010, similar to current finance lease accounting with its resultant expense front-loading; and others (‘type B’ leases) will apply a straight-line expense recognition pattern, similar to current operating lease accounting. However, this has also been withdrawn and the IASB tentatively decided in March 2014 to adopt a single approach for lessee accounting, where a lessee would capitalise all its leases on its balance sheet.

Lessor accounting

The proposals for lessor accounting have also changed since the 2010 ED. Consistent with lessee accounting, lessors will identify leases as either type A or type B, using the same criteria. For type B leases, the lessor will follow accounting that is similar to current operating lease accounting. For type A leases, the lessor will derecognise the underlying asset and replace it with a lease receivable (measured at the present value of the lease payments) and a residual asset (measured at the present value of the estimated residual value at the end of the lease term plus the present value of any expected variable lease payments). Any profit relating to the receivable component is recognised immediately, whereas profit relating to the residual component is deferred until the underlying asset is re-leased or sold by the lessor. Interest income on both the receivable and the residual asset is recognised over the lease term.

However, in March 2014 IASB tentatively decided not to amend the existing accounting requirements for lessor since there is no problem with the current lessor accounting.

Distinguishing between a lease and a service

The ED includes new guidance on assessing whether a contract contains a lease or a service, or both. This guidance is different from the current IFRIC 4 analysis and might result in some contracts being treated differently.

Almost all companies enter into lease arrangements, so the proposals will have a pervasive impact. But certain types of leases are excluded from its scope, namely:

- leases of intangible assets;

- leases to explore for or use natural resources;

- leases of biological assets; and

- service concession arrangements within the scope of IFRIC 12.

In addition, both lessees and lessors can elect, by class of underlying asset, to account for leases with a maximum term of up to 12 months in a similar way to current operating lease accounting.

Summary

In addition to the amendments discussed above, there are more changes to accounting standards proposed, for example revenue recognition. Accounting under IFRS will continue to evolve in the near future.

The application of IFRS has a significant impact on the roles of not only finance personnel, but also treasurers. To implement the continuously evolving accounting requirements effectively, companies have to evaluate their impacts on systems, processes, controls and people. In addition, all these impending changes will have pervasive operational impacts:

- All financial instruments need to be reassessed for their appropriate classification under IFRS 9.

- Appropriate valuation models to fair value unquoted equity instruments need to be developed.

- Changes in fair value of financial liabilities due to changes in own credit risk need to be determined.

- Accurate credit risk assessment at origination of receivables is required and expected cash flows over the life have to be continuously assessed.

- Evaluate impact of lease standard on individual leases and its effect on covenants and financial ratios.

Furthermore, comparative figures will be required. It is recommended to start implementation of the new standards at an early stage as enormous changes to processes and systems may be required. Time and resources are required to embed these changes.

Entities need to consider whether they are able and wish to adopt particular standards early to capitalise on the transitional provisions in the standards. Entities will need to plan and prepare carefully for the transition to the new IFRS requirements. Some factors to be considered are listed below:

- Developing a plan/process to evaluate and incorporate changes.

- Educating the various business divisions and evaluating potential impact.

- Evaluating between embedding changes into systems and processes and adoption of interim solutions.

- Availability of data requirements.

- Scalability of systems and processes to accommodate further changes in IFRS over next few years.

- Adequacy of resources required for implementation.

- Interaction between IFRS adoption and other finance projects, for example e.g. standardisation and automation of finance processes.

Keep up to date with the developments. Be prepared. Start now.