Climate change: testing the resilience of corporates’ creditworthiness to natural catastrophes

| Risk management | |

|---|---|

| |

| Authors | |

| Miroslav Petkov | Standard & Poor’s, London |

| Michael Wilkins | Standard & Poor’s, London |

Introduction

While recent history shows that natural catastrophes may have not been a major rating factor on corporate credit quality in the past, their effect in the future may increase considerably if, as scientific evidence suggests, we experience more frequent and more extreme climatic events. If such extreme events were to occur, companies’ existing insurance and overall disaster risk management measures could, in the opinion of Standard & Poor’s Ratings Services, become considerably less effective. Therefore, we see improvements in companies’ disclosures about their exposure to natural catastrophes becoming more relevant to our ratings analysis.

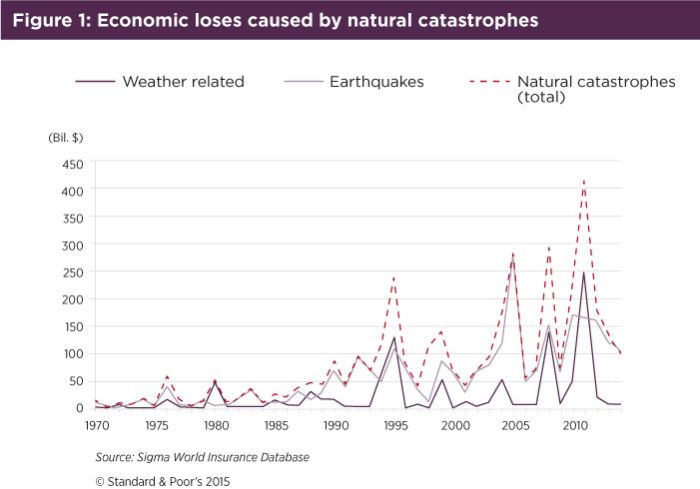

The economic cost of natural catastrophes has risen significantly over the past 10 years (see Figure 1 below). However, through a combination of existing preventive measures, most of the companies we rate have managed to mitigate the impact of such events on their corporate credit profiles. Nevertheless, with scientists predicting an increase in extreme climatic events, firms’ vulnerability to natural catastrophes is in our view likely to be sorely tested.

Overview

- Generally, companies have so far managed to mitigate the effects of natural catastrophes through liquidity management, insurance protection, natural disaster risk management, and post-event recovery measures.

- However, the more frequent and more extreme climatic events many scientists predict could adversely affect companies’ credit profiles in the future.

- Greater disclosure of firms’ exposure to extreme natural catastrophes should, in our opinion, encourage them to bolster their resilience to these events and thereby aid transparency.

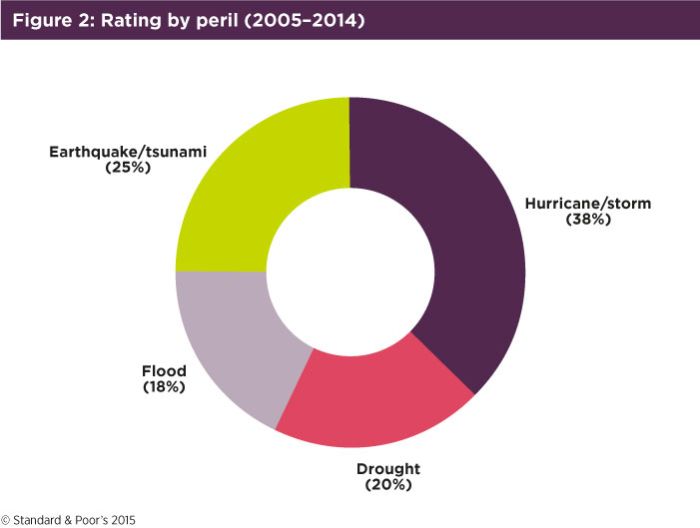

Catastrophes seldom trigger rating actions – yet

Although natural catastrophes can result in companies experiencing property losses and production and market disruptions, such events are not frequently a factor behind our negative rating actions. Since 2005, we have identified natural catastrophes (tropical storms, floods, droughts, and earthquakes) as the main or material contributing factor for at least 60 negative rating actions (comprising downgrades and outlook revisions). This compares with around 6,300 corporate credit downgrades on companies in total over that period. In addition, we revised our outlook on less than five companies to stable from positive as a result of natural catastrophes. Overall, we find that companies’ liquidity management, insurance protection, natural disaster risk management, and post-event recovery measures were adequate in mitigating the impact of natural catastrophes on their rating profiles during the period.

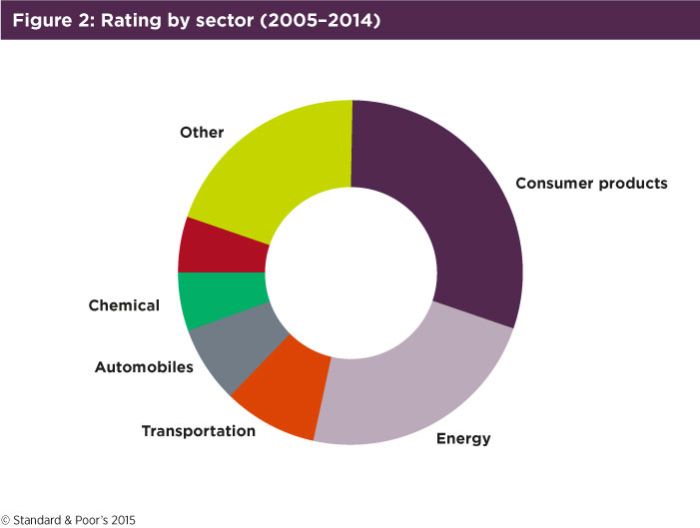

Energy and consumer products sectors most at risk

While our sample of negative rating actions is too small to draw robust statistical conclusions, our analysis provides insights into how and when natural catastrophes can affect companies’ creditworthiness. No sector is immune to the effects of natural catastrophes. However, the energy sector (through a direct impact on production and distribution facilities and market dislocation) and the consumer products sector (through supply chain and market disruptions) appear most exposed, together representing more than one-half of the affected sample. This is about double the proportion of rated companies that make up each of those sectors.