The Renminbi takes centre stage: knowlege is power

| Risk management | |

|---|---|

| |

| Author |

Introduction

The internationalisation of the Renminbi (RMB) is vital to China’s success on the global economic stage. The rapid development of China’s economy has outpaced the liberalisation of its financial system. Heavily regulated financial markets are no longer able to service China’s increasingly sophisticated and complex economy. Key aspects of China’s financial reform are the internationalisation of the RMB, liberalisation of interest rates and relaxation of capital account controls.

The journey to date

Financial reforms require a strategic and careful sequencing of policy. To complement the financial reforms, China will also need to strengthen its risk management skills, update its regulatory capacity and adopt a consistent monetary policy framework.

In order for the RMB to be a true global currency, it needs to become a currency of choice for deposits, trade, investments and central bank reserves. Its internationalisation journey began in 2004 when Hong Kong residents were allowed to hold RMB deposits in their Hong Kong bank accounts. Five years later, Chinese merchants were allowed to settle their cross-border trade with their foreign trading partners in RMB. Since then, the RMB has accelerated its international journey and has received a warm welcome onto the global financial stage.

From a currency that was not widely circulated in the offshore market five years ago, the RMB today accounts for one quarter of China’s cross-border trade settlements, with the daily average turnover of RMB real-time gross settlements close to RMB800 billion. This progress has led to the RMB ranking among the world’s top five payment currencies and top two documentary credit currencies for trade, according to financial messaging services provider SWIFT.

In 2014, a number of major developments shifted the RMB’s international journey to the fast lane. These changes included the appearance of numerous RMB clearing banks and hubs outside of Asia, the establishment of pilot free-trade zones to test financial market deregulation and the rollout of several reforms across China.

As China accelerates the liberalisation of its capital markets, both onshore and offshore RMB transactions will rise sharply. The currency is now appearing in the investment portfolios of global central banks and sovereign wealth funds, which is a key step towards the RMB becoming a reserve currency in global markets. Undoubtedly, there will be volatility on the journey but all signs point to the inexorable ascent of the RMB, with 2015 shaping up to be another critical year in the currency’s rise to prominence on the world stage.

The journey ahead

Looking ahead, the offshore RMB market will continue to prosper. Some institutional developments in 2014 were ground breaking and have laid a solid foundation for the Chinese currency to play a greater role internationally.

Global flows of RMB will rise on capital account liberalisation

China will continue to liberalise its capital account and allow freer flows of cross-border funds. Alongside increasing the quotas for QFII, QDII, RQFII and RQDII, RMB can also be used to settle cross-border portfolio flows. The successful launch of the Shanghai-Hong Kong Stock Connect in November 2014 is profound, as onshore investors can use their RMB to invest in Hong Kong’s listed companies. Vice versa, offshore investors can raise RMB to support their onshore securities exposure. To complement the Shanghai programme the Shenzhen-Hong Kong Stock Connect is also expected to launch later in 2015 and provide even more access to China’s financial markets. We also expect further liberalisation of capital controls in the near future, which may allow individual Mainland Chinese investors increased access to offshore investments under capital account without the need to use the existing QDII and RQDII framework which can only be accessed by institutional investors. This reform is likely to be piloted in the China (Shanghai) Pilot Free Trade Zone (SFTZ) as a starting point under a new Qualified Domestic Individual Investor (QDII2) scheme.

Corporate use of cash pooling set to take off in more free-trade zones

The SFTZ cash pooling scheme is an exciting development. Foreign investors and multinational corporations have long struggled to repatriate their funds from the onshore market. China’s regulators now allow companies to move funds overseas in the form of an inter-company loan. With the establishment of Free Trade Units (FTU) in Shanghai’s banking system in 2014, this process will become easier. Furthermore, inflows and outflows of funds sitting in FTU accounts with the rest of the world no longer require specific approval by the State Administration of Foreign Exchange (SAFE). A virtual offshore RMB market is now established within mainland China. As the free trade zone initiative is now extending to Guangdong, Fujian and Tianjin, the volume of such flows is likely to increase dramatically.

Offshore RMB deposits will rise exponentially

While the RMB exchange rate may become more volatile, offshore RMB deposits will continue to grow. Hong Kong’s RMB deposits will grow by about 15% in 2015 while the removal of daily conversion caps will boost wealth related products. Additionally, with the installation of clearing facilities in other financial markets in 2014, including London, Sydney, Seoul and Frankfurt, RMB deposits in these financial centres are bound to rise exponentially. We project that total offshore RMB deposits will grow by another 20% in 2015 and may reach RMB2.3trn by the end of the year.

China International Payments System (CIPS) to revolutionise international RMB settlements

For RMB settlements, China has historically relied on its domestically focussed China National Advanced Payments System (CNAPS). However, as the RMB is increasingly being used outside of China’s borders, the CNAPS system has surpassed the boundaries of its intended user base and a new international settlement system, in the form of CIPS, has been in the works for several years to accommodate the globalisation of the Chinese currency. Originally slated for launch in 2014, CIPS is expected to be operational in late 2015 and will provide a more standardised and internationally consistent messaging framework for international RMB payments. Such a framework is a key step to increasing use of the currency and is expected to reduce transaction costs, reduce message rejections and cut down processing times which will greatly assist in growing RMB payment volumes.

‘Renminbisation’ occurs in commodity markets

To some extent, the USD enjoys its global status as it is the currency to price and settle transactions in international commodity markets, such as gold, oil, base metals and agricultural products. For the RMB to internationalise, such engagements are critical. The launch of the international board by the Shanghai Gold Exchange in the SFTZ and three metal futures by Hong Kong exchanges in 2014 were just the first step. While the short-term outlook of the RMB-denominated global commodity market may not be favourable to transaction volumes, relevant institutions will still devote their efforts to enrich the product suite.

Is the RMB already an international currency?

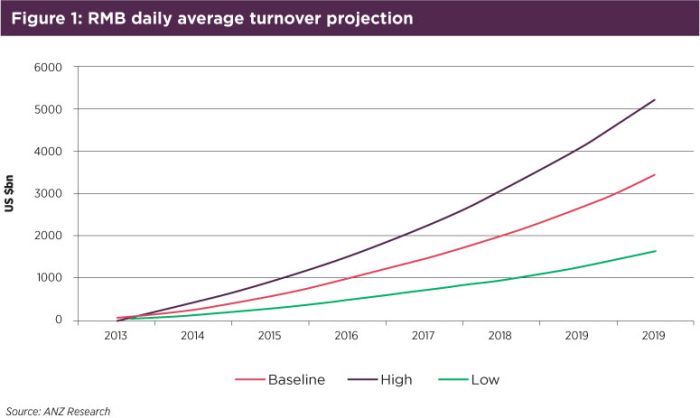

The RMB is heavily used in cross-border trade settlements with approximately 25% of China’s cross-border trade settling in RMB during 2014. A similar trend has been observed in early 2015. RMB-denominated financial instruments are already available for individual and institutional investors in the international market. Spot, forward and other financial derivatives are actively traded in global financial centres with volumes expected to grow significantly in the future (see Figure 1 below). By these metrics alone, the RMB should already be considered an international currency.

The Chinese authorities have also set up the core financial infrastructure to supply RMB liquidity in offshore markets, with seven new RMB clearing banks established outside of China in 2014 alone and three more confirmed since the beginning of 2015 (see Figure 2). The People’s Bank of China (PBoC) has also been very active since 2008 in signing Bilateral Swap Agreements (BSA) with the central banks of 28 nations with an aggregate value in excess of RMB3trn (as at December 2014). These BSAs act as a means of supporting growing cross-border RMB investment and trade and to ensure adequate offshore RMB liquidity is available given the current lack of full convertibility of the currency. Offshore deposits will likely continue to grow exponentially thanks to the establishment of these clearing banks in Asia and Europe and further internationalisation of the RMB. Total offshore deposits reached RMB1.9 trillion at the end of 2014, with Taiwan, Singapore, Korea and Macau catching up with Hong Kong as deposit centres. Europe also saw significant deposits with RMB20.5 billion recorded in Luxembourg and RMB5 billion in London.