European high-yield market coming of age

| Corporate finance | |

|---|---|

| |

| Authors | |

| Mario Santangelo | Associate Managing Director |

| Sandra Veseli |

Managing Director Moody's Investors Service Moody’s Investors Service |

Introduction

The European high-yield market has grown very strongly in recent years, with record issuance of $121bn from our speculative-grade rated companies in 2014, as shown in Figure 1 below. We believe that issuance volumes will remain stable throughout 2015, although market liquidity is less predictable than it was in 2013 and the first half of 2014, when investors’ search for yield coupled with improving macroeconomic forecasts in Europe led to a strong technical backdrop, with significant capital inflows and tightening of credit spreads.

[File:Fig1-High-yield-issuance-volumes-in-EMEA.jpg|725px|center]]

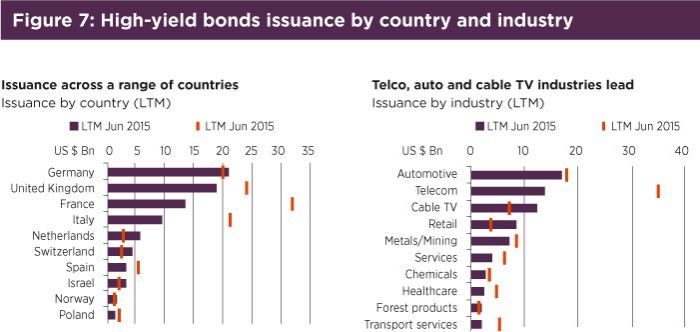

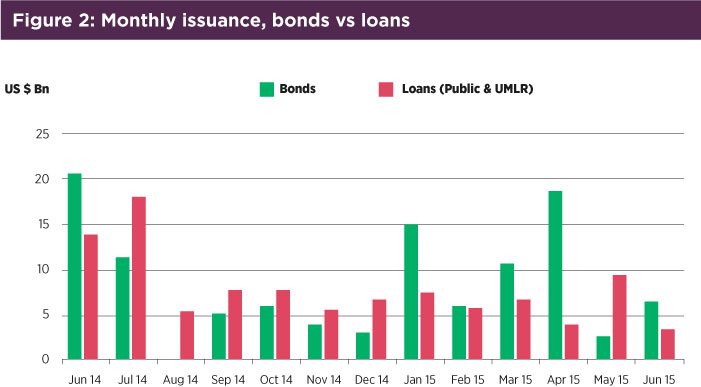

In the last 12 months, the market faced a number of woes, including, but not limited to, intense negotiations on a bailout plan for Greece, a slowdown in economic growth in China and heightened geopolitical risk which culminated in sanctions to Russia. Nevertheless, the market has remained open to repeat, well-known issuers and constructive towards a select number of first-time issuers with strong credit fundamentals. However, the leveraged loan market has demonstrated greater stability than the high-yield bond market at times of stress and volatility. As shown in Figure 2, bond volumes have been lower than that of loans in the second part of 2014, as well as in May and June of 2015.

Significant growth in volumes of high-yield bonds issued in the last five years

Volumes of rated high-yield bonds reached $121bn as of year-end 2014; this was a record year for the high-yield market in Europe, supported by improving macro-economic conditions and renewed interest from investors. The size of the high-yield bond market has effectively doubled since 2010, fuelled by the refinancing of previously unrated bank or CLO-funded leveraged buyouts (LBOs) in the capital markets. The capital structure for those companies was initially put in place in the 2005 to 2007 LBO boom. However, Figure 3 shows that this structural transformation has slowed down as it nears completion.

[File:Fig3_Bank_to_bond_transformation_nearing_completion.jpg|700px|center]]

Despite this trend, Figure 4 shows a growing number of rated first-time, high-yield issuers in Europe, the Middle East and Africa that accounted for 25% of volumes in 2014, supporting our view that small- and medium-sized companies continue to transition from traditional bank-to-bond financing. However, for the high-yield market to grow this year and beyond it would require a steady volume of M&A (mergers and acquisitions)-driven issuance and primary leveraged buyouts, because the stock of debt to be refinanced has reduced compared to previous years.

More limited windows of financing opportunities in the high-yield bond market

We expected stable issuance volumes in 2015 because of:

(i) low interest rates in the Euro area resulting in attractively low bond coupons; (ii) slowly improving macro conditions with our GDP growth expectations in the Euro area revised upward to 1.5%; (iii) investors’ continued search for yield and absolute returns supporting demand for high-yield bonds and, (iv) M&A-driven issuance.

At the same time, the liquidity of the high-yield market is likely to be more volatile because of a growing number of negative catalysts. In January and February 2015, the market paused, waiting for details of the Quantitative Easing (QE) programme by the European Central Bank. In May, the market took another breath in light of the elections in the UK and the intensifying debate around a potential ‘Brexit’ and, most recently, in July the high-yield bond market completely shut for two weeks amid concerns around the resolution of the Greek financial crisis.

As a result, in the first half of 2015 the volatility of credit spreads kept new issuers on the sideline which, coupled with a lack of supply from private equity sponsored LBO deals, has caused a 36% decline in high-yield bond volumes to $59bn as shown in Figure 5. There were only 13 new issuers in the first half of the 2015 compared to 36 in the same period of 2014. The market has been dominated by repeat issuers, especially those rated in the Ba category, that have refinanced outstanding bonds at lower coupons.

Despite this slowdown, issuance remained well ahead of the second half of 2014 ($59bn in H1 2015 vs $29bn in H2 2014; see Figure 5 below). High-yield bond issuance dropped significantly from August onwards in 2014 on the back of a multitude of reasons, including a phasing effect with a large supply glut in July ahead of the summer break, increasing geopolitical tensions with the introduction of sanctions against Russia, the sudden default of Phones4U in September 2014 and the resurfacing of Eurozone uncertainties with the elections in Greece. While concerns over Greece and the slowdown in China will continue to influence the debt capital markets, the issuance profile for 2015 could be more balanced resulting in bond volumes for the full year still approaching last year’s levels.